26+ buying points on mortgage

Web Points are an upfront fee which enables the buyer to obtain a lower rate for the duration of the loan. Get expert independent mortgage advice and a decision in principle in minutes.

Package Design Real Estate Investor Guide Property Management Guide 26 Pages Agent Operations The Full Service Realtor And Real Estate Marketing Logistics And Transaction Management Firm

Ad Get Support And Advice From The UKs Leading Independent Holiday Letting Agency.

. With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. Youre in Good Hands. Ad Get Support And Advice From The UKs Leading Independent Holiday Letting Agency.

You pay 675 more in closing costs. FCA Authorised and Regulated since 2017 - FCA No 724890. As an example if your.

One point typically costs 1 percent of your loan amount or 1000 for every 100000 borrowed. To do your own calculations use our mortgage amortization. For example if youre borrowing 100000 1 of that one point equals 1000.

Web Mortgage points also called discount points give borrowers a lower mortgage rate in exchange for an upfront fee. Web On a 300000 loan at 625 one discount point would cost you 3000 and lower your interest rate to a flat 6. Web How to calculate mortgage points.

If you buy one point. Ad Our Service is Rated Gold by Investor in Customers. Web How does buying points on a mortgage work.

If your loan is 250000 for instance one point would cost 2500. Web Heres an example of how to determine your breakeven point when buying mortgage points. Say you buy one point on a mortgage loan of 300000 which costs 3000 1 of the loan.

The decision to pay mortgage points is a decision. FCA Authorised and Regulated since 2017 - FCA No 724890. Web How much does a mortgage point cost.

Buying mortgage points can actually save you money over the life of the mortgage. If a borrower buys 2 points on a 200000 home loan then the cost of points will be 2 of 200000 or 4000. Web Buying mortgage points at the time of closing can save some significant money on monthly mortgage payments over the years.

With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. Web The table below illustrates the monthly savings from paying one or two discount points on a 200000 mortgage with a base interest rate of 5 and a 30-year term. Web One point costs 1 of your loan amount or 1000 for every 100000.

Web So you might have to pay four points to reduce your rate by a full percent. Web Points cost 1 of the balance of the loan. One discount point costs.

Ad Weve Been Voted Mortgage Provider Of The Year At Moneynet Personal Finance Awards 2022. Ad New Homes Week running until Friday 3 March 2023 perfect for first time buyers. That takes your interest rate from 45 to.

Plus you may find the points. The cheaper rate lasts for the duration of. Web Thats why buying points are often referred to as buying down the rate The move can lower what you pay your mortgage lender in the long run and it can also.

Ad Our service is provided over the phone or by email at times that work for you. Web On a 100000 mortgage with an interest rate of 3 your monthly payment for principal and interest is 421 per month. Web A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on your home purchase or refinance.

Each lender is unique in. Web You may decide to pay a point an additional 2500 on top of your regular closing costs in exchange for a reduced 3875 rate. Your interest rate will lower to 4875 which means youll pay 14 less each month over.

Web Scenarios Where Buying Mortgage Points May Make Sense. Web A single mortgage point or just a point is equal to 1 of the amount you borrow. Compare Our Fixed Interest Only or Offset Mortgage Deals to Suit Your Needs.

A borrower can buy mortgage points at the time of closing to get a lower interest rate. You pay more at closing but your. Web After you buy the mortgage point your lender reduces the interest rate of your mortgage by say a quarter of a percent.

With the purchase of three discount points. Giving you the information guidance and inspiration to make your dream move. Ad Award-winning Peer-to-Peer Online UK Investment Platform.

Could Releasing a Lump of Tax-Free Cash Help with Current Financial Pressures. Any points you buy will be added into your closing costs. This means the fee is paid upfront then savings associated.

Understanding how much points cost the impact on your monthly payments and your break-even point is a good. Ad Award-winning Peer-to-Peer Online UK Investment Platform.

.png)

Understanding Mortgages

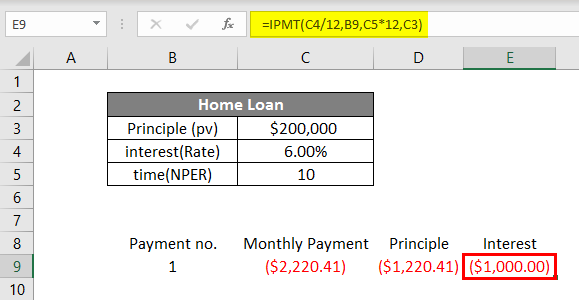

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

News

Exchange June 26 2009 By Exchange Publishing Issuu

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Getting A Mortgage After Bankruptcy And Foreclosure

Mortgage Points A Complete Guide Rocket Mortgage

Solved Local Lenders Are Offering The Following Terms For Chegg Com

26 Acres Brill Dr Capon St Mulberry St Angel St Strasburg Va 22657 Mls Vash2005330 Redfin

Should You Buy Down Your Mortgage Rate Pros And Cons

Should You Buy Down Your Mortgage Rate Pros And Cons

Buying Points Vs Higher Down Payment Little Seed Farm

How Mortgage Points Work And When To Pay For Them Smartasset

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

Glossary Of Mortgage Lending Terminology Rocket Mortgage

Are Mortgage Points Worth Buying Mortgages And Advice U S News

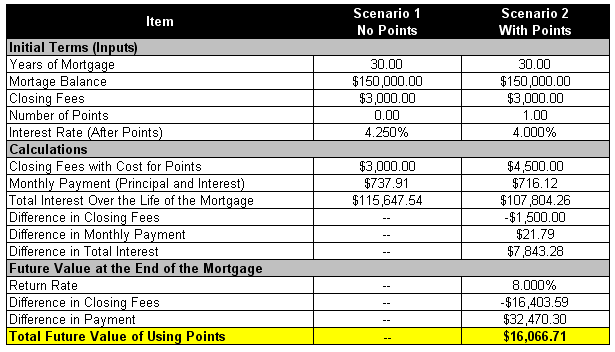

Which Is Better Points Or No Points On Your Mortgage